These major robo advisors cost minimal charges but nevertheless offer you significant-high-quality capabilities, such as automated portfolio rebalancing, publicity to A selection of asset classes and economic planning equipment. Some also offer usage of fiscal advisors.

Standard IRA: This sort of IRA permits you to spend money on a pre-tax basis, meaning that you just could possibly avoid spending taxes on any contributions.

Avoid transactions that gain you or disqualified persons out of your IRA investments. Applying IRA assets for personal use, for example living in a residence your IRA owns, can result in penalties.

Editorial Notice: Thoughts, analyses, reviews or recommendations expressed on this page are These on the Find editorial team’s alone, and possess not been reviewed, permitted or normally endorsed by any 3rd party.

Additional costs: Custodians might charge supplemental expenses for controlling alternative assets within your SDIRA. As an example, you might be billed yearly storage costs for real-estate or transaction fees certain to purchasing and providing sure investments.

Before opening a self-directed IRA, think about day-to-day brokerage-primarily based IRAs initially. Don't just will you possible have much much less charges and transaction costs. You’ll also have entry to numerous non-conventional asset lessons by way of pooled investments like mutual money and other ETFs.

To assist you to locate the best account for your requirements, Forbes Advisor has uncovered what it considers being the ideal self-directed IRAs, you will need to be prepared to do extra homework into investments than you might get away with for a standard IRA. The consequences should you don’t may be devastating.

Dividend stocks is usually a terrific choice for traders on the lookout for passive revenue and portfolio security. See our checklist of the best higher-dividend shares and learn the way to speculate in them.

need to lender your retirement long run on one thing as unpredictable as copyright or as complex for a “tax lien certification”? Ought to I Spend money on a Self-Directed IRA?

Who Delivers SDIRAs? Nevertheless some banking companies and institutions keep away from supplying SDIRAs, this sort of account is Nevertheless extensively accessible by many various custodians. Based on the asset course you have an interest in, many SDIRA corporations can offer you Everything you are trying to find.

In case you violate the prohibited transaction rules, the IRS can strip your account's IRA position. That is dealt with for a taxable distribution of all assets inside the account as of January one.

Before opening an SDIRA, it’s essential to weigh the potential wikipedia reference advantages and drawbacks based upon your precise fiscal ambitions and chance tolerance.

Insufficient transparency. It might be hard to determine the monetary truly worth of an investment, particularly when getting and providing. The Securities and Trade Fee (SEC) warns buyers that self-directed IRA promoters from time to time checklist the acquisition price tag, or the purchase price tag additionally expected returns, as being the valuation.

The Gold membership is probably going an even better Resolution for Energetic see this investors who need a white glove-stage expertise, which includes priority aid and expedited support.

Hallie Eisenberg Then & Now!

Hallie Eisenberg Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Meadow Walker Then & Now!

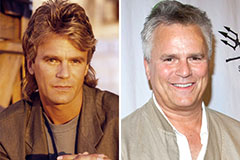

Meadow Walker Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!